Tata Power, one of India’s largest integrated power companies, has been at the forefront of the energy sector for over a century. With a diverse portfolio of conventional power generation, renewable energy and power distribution, Tata Power is a key player in shaping the future of India’s energy landscape. For investors and stakeholders, understanding the Tata Power share price target over the next few decades is important to make informed decisions. This blog will explore the potential share price targets for Tata Power in 2025, 2026, 2030, 2040, and 2050, considering both short-term and long-term factors.

Table of Contents

Overview of Tata Power Share Price

Company name | Tata Power Company Limited |

NSE symbol | TATAPOWER |

Market Cap | 136761 cr |

52 week low | 230.80 |

52-week high | 471 |

Tata Power's Current Market Performance

According to the latest financial reports, Tata Power has demonstrated strong market performance due to its diversified business model and strong growth in the renewable energy sector. The company’s share price has risen steadily over the past few years, reflecting investor confidence in its prospects.

Key financial metrics such as revenue, EBITDA and net profit margin have seen consistent improvement. Tata Power’s debt reduction efforts as well as strategic disinvestments and partnerships have strengthened its balance sheet. The company’s focus on expanding its renewable energy portfolio including solar, wind and hydro projects has positioned it favorably in the market.

Industry-wise, Tata Power is considered a leader in renewable energy with ambitious plans to expand clean energy capacity. The company’s transition from conventional to renewable energy sources is in line with global and domestic trends toward sustainability, making it an attractive option for long-term investors.

Financial Performance of Tata Power

Years | Revenue | Profit | Net Worth |

2020 | 29699 | 1727 | 21898 |

2021 | 33143 | 1485 | 25250 |

2022 | 43736 | 2623 | 26028 |

2023 | 56547 | 3810 | 34204 |

2024 | 63272 | 4280 | 38333 |

Revenue Growth: From 2020 to 2024, Tata Power’s revenue experienced significant growth, increasing from ₹29,699 crore to ₹63,272 crore. This impressive rise was driven by the company’s strategic expansion into renewable energy, increased demand for power, and successful acquisitions and partnerships.

Profit Growth: Tata Power saw a significant increase in profits, from ₹1,727 crore in 2020 to ₹4,280 crore in 2024. Profit growth each year reflects the successful implementation of Tata Power’s long-term strategies and its strong financial management, positioning the company for continued success in the energy sector.

Networth: Tata Power’s net worth increased from ₹21,898 crore in 2020 to ₹38,333 crore in 2024. The company sees steady growth with notable upside between 2022 and 2023, reflecting successful investments and expansion efforts.

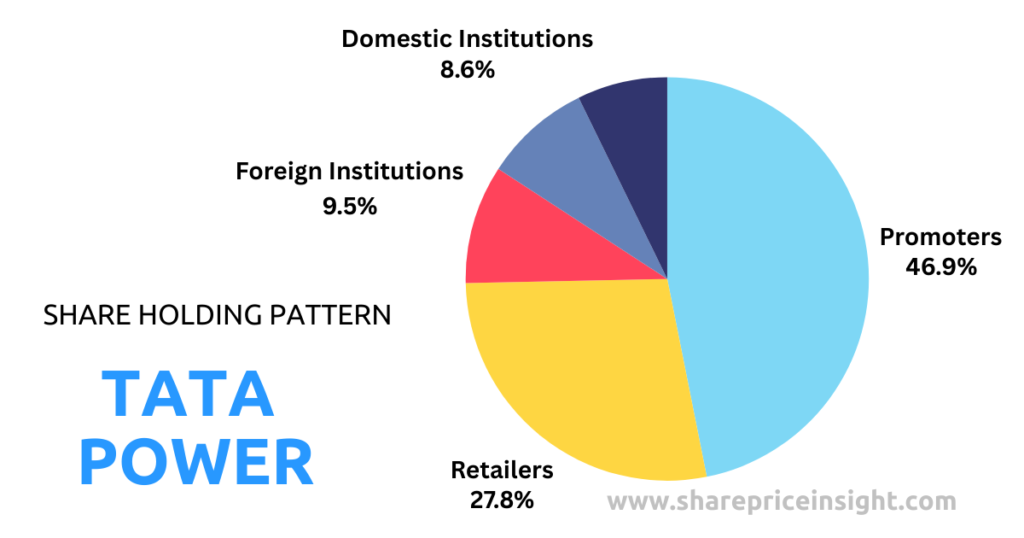

Tata Power Share Holding Pattern

Tata Power Share Price Target 2025

By 2025, Tata Power is expected to see significant growth, primarily driven by its expanding renewable energy portfolio. The company’s ongoing projects in solar and wind energy, as well as its leadership in distributed generation and rooftop solar solutions, will contribute to revenue growth. Based on current estimates and market trends, the estimated Tata Power share price target could be between Rs. 530-590 by 2025.

Tata Power Share Price Target for 2026

Between 2025 and 2026, Tata Power’s growth will likely be driven by the full commissioning of ongoing projects and realization of synergy from its recent acquisitions and partnerships. The company’s continued focus on cost optimization and operational efficiency will further strengthen its financial performance. Tata Power’s share price target could reach Rs 660-690 by 2026, reflecting the company’s growth in renewable energy and its strategic initiatives.

Tata Power Share Price Target for 2030

Looking towards 2030, Tata Power is expected to be a major player in India’s renewable energy market. The company’s focus on achieving carbon neutrality and expanding its clean energy portfolio will be at the heart of its growth strategy. Tata Power’s share price is estimated to potentially range between Rs 1250-1550 by 2030, as the company benefits from its extensive renewable energy initiatives.

Tata Power Share Price Target for 2040

By 2040, Tata Power envisions to be at the forefront of India’s energy transition. The company’s strategy will include a balanced mix of renewable energy, energy storage solutions and digitalization to efficiently manage energy demand and supply. By 2040, Tata Power’s share price could be between Rs 2110-2930, reflecting its leadership in the renewable energy sector and its diverse energy solutions.

Tata Share Price Target for 2050

Looking towards 2050, Tata Power is expected to be a major player in the global energy market. The company’s long-term vision includes becoming a net-zero carbon emitter, leveraging cutting-edge technologies such as hydrogen energy, advanced energy storage and smart grid solutions. Given the potential for significant technological and market transformations, continued growth in the renewable energy sector and successful implementation of its long-term strategy, Tata Power’s share price could reach Rs 3,300-4,100 by 2050.

Factors Influencing Tata Power’s Future Growth

a. Renewable Energy Initiatives and Future Plans:

Tata Power has been at the forefront of India’s renewable energy revolution. The company aims to achieve 80% of its generation capacity from clean energy sources by 2030. With significant investments in solar and wind energy, Tata Power is well positioned to capitalize on the growing demand for green energy.

b. Government Policies and Impact on the Energy Sector:

The Government of India has set ambitious targets for renewable energy capacity, aiming for 450 GW by 2030. Policies such as tax incentives, subsidies and favorable regulatory framework will support Tata Power’s expansion plans. The government’s push towards electric vehicles (EVs) and development of charging infrastructure also offers new avenues for growth.

c. Technological Advancements in Energy Production:

Technological innovations in energy storage, smart grids and energy efficiency will play an important role in the future of Tata Power. The company’s investments in advanced technologies such as battery storage systems and digitalization will increase operational efficiency and grid reliability.

d. Global and Domestic Market Trends:

The global transition towards a low-carbon economy will increase demand for renewable energy. Tata Power’s strategic alliances with international players and its focus on expanding its global footprint will be key growth drivers. Additionally, India’s growing energy needs, driven by urbanization and industrialization, will ensure sustained demand for electricity.

Conclusion

The future looks promising for Tata Power, with the company well positioned to take advantage of the ongoing energy transition. The “Tata Power share price targets” for 2025, 2026, 2030, 2040 and 2050 will be shaped by a combination of market conditions, regulatory changes, technological advancements and Tata Power’s strategic initiatives. For investors, it is important to understand these factors to make informed decisions and maximize returns in the long run. As Tata Power continues to innovate and lead in the energy sector, its share price is likely to reflect its growing influence and success.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Investing in the stock market involves risk, and readers should conduct their own research and consult with qualified financial professionals before making investment decisions. The projections and targets mentioned are speculative and based on current available information, which may change over time.

FAQ

Current market share price of Tata Power should be checked on reputed financial news site.

Tata Power is considered a good long-term investment due to its stable business model. However, like any investment, it’s essential to consider potential risks and market conditions.

There are so many factors which will directly affect the share price of Tata power such as market demand, government policies and corporate governance.